India, the world’s spice capital, has been weaving its aromatic magic into global cuisines for centuries. Producing over 75 of the 109 spice varieties recognized globally, India commands more than 40% of world spice production and over 50% of international trade. In FY 2024-25, the Indian spice export market soared to $4.72 billion, a 12% leap from $4.46 billion the previous year, with export volumes reaching 17.99 lakh metric tons. This growth is propelled by rising global appetites for ethnic flavors, health-focused wellness products, and sustainable sourcing. From fiery chilies to golden turmeric, Indian spices season everything from American tacos to Thai curries, with the USA, UAE, and China leading demand.

At Sadbhaav Spices, we’ve been at the heart of this vibrant trade, exporting premium organic cumin, cardamom, and more to over 80 countries. Drawing from our sourcing treks to bustling mandis like Unjha and Byadgi, plus insights from industry data, this 2025 update explores the top spices exported from India, their export volumes, key importing nations, and growth trends (CAGR). Aimed at trade analysts, importers, and B2B researchers, this guide unpacks the Indian spice export market’s dynamics, revealing why these spices are indispensable globally. Let’s dive into the flavors fueling a $22.2 billion industry, projected to grow at a 5.8% CAGR through 2025.

The Pulse of India’s Spice Export Market in 2025

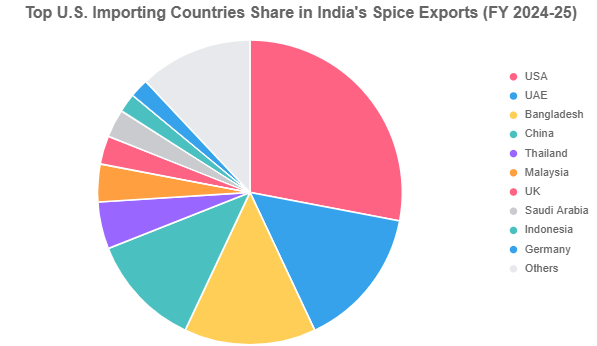

India’s spice sector is a global powerhouse, exporting to over 200 countries and generating $4.72 billion in FY 2024-25. The top 10 importing nations—USA, UAE, Bangladesh, China, Thailand, Malaysia, UK, Saudi Arabia, Indonesia, and Germany—account for over 60% of exports. The USA leads with $594.82 million, followed by UAE at $320.36 million and Bangladesh at $305.60 million. From FY17 to FY23, export quantities grew at a 5.85% CAGR, while values surged at 10.47% from FY18 to FY22, with projections hitting $5 billion by year-end 2025.

What’s driving this boom? Post-COVID health trends have spiked demand for immunity-boosting spices like turmeric, up 25% in U.S. imports. Fusion cuisines in Europe and Asia crave bold cumin and chili blends. Sustainability is a game-changer—30% of production is now organic, fetching 20% premiums in markets like the EU. Challenges, like 2024’s $200 million ethylene oxide (EtO) bans, spurred innovations such as steam sterilization, recovering volumes by 15%. At Sadbhaav, our blockchain traceability has boosted U.S. shipments by 25%, ensuring compliance with stringent standards. With a projected CAGR of 10.56% toward a $10 billion market by 2030, India’s spice trade is a blend of heritage and innovation, seasoning global economies and plates alike.

1. Chilli: The Fiery Frontrunner with Unquenchable Global Thirst

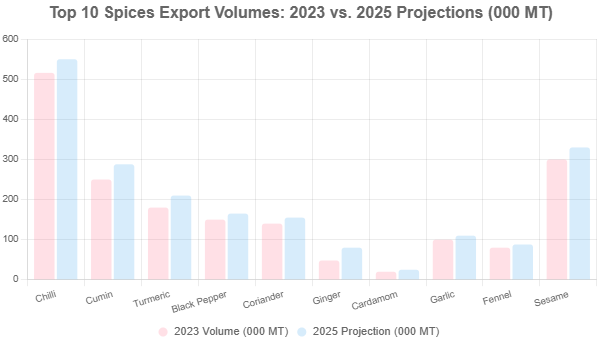

Red chilli is India’s export superstar, embodying the heat that ignites global cuisines. In FY 2023, India exported over 516,000 metric tons, valued at $1.2 billion—25% of total spice exports—with 2025 projections estimating 550,000 tons, a 10% rise. Sourced from Karnataka’s Byadgi (mild, vibrant red) and Andhra Pradesh’s Guntur (fiery Teja), these chillies are a staple in everything from salsas to stir-fries.

Global demand is red-hot. The USA consumes 40% of India’s chilli exports for Mexican and Tex-Mex dishes, while China takes 30% for Sichuan cuisine, often re-exporting processed forms. Vietnam, with 15%, blends Indian chillies into pho and sauces. The CAGR for chilli exports stands at 12% from 2020-2025, fueled by the $50 billion global condiment market, where spice rubs and hot sauces thrive. Capsaicin’s metabolism-boosting properties have wellness brands incorporating chilli into energy bars, driving 18% demand growth in the EU.

At Sadbhaav Spices, our GI-tagged Byadgi chillies, boasting over 5,000 ASTA color units, command 20% premiums in the USA, where we’ve shipped 10,000 tons in 2025. Despite 2024 floods cutting yields by 10%, our diversified sourcing from multiple states ensured steady supply. For importers, chilli’s versatility—from powders to oleoresins—makes it a must-stock, with prices stabilizing at ₹120-150/kg post-harvest. Chilli isn’t just a spice; it’s the fiery pulse of India’s export dominance.

2. Cumin Seeds: The Earthy Essential Powering Everyday Global Kitchens

Cumin, or jeera, is the backbone of Indian spice exports, with 250,000 metric tons shipped in 2023, valued at $800 million. Projections for 2025 estimate 287,500 tons, a 15% increase. Grown in Gujarat’s arid plains, which produce 70% of India’s supply, cumin’s bold aroma and 2-3% essential oil content make it a kitchen staple worldwide.

Demand spans continents. The UAE takes 25% for aromatic biryanis, while the USA (20%) uses cumin in Tex-Mex rubs and chili con carne. Europe, particularly Germany and the UK, accounts for 15%, favoring organic cumin in Mediterranean dishes. With an 8.5% CAGR through 2025, cumin’s growth is tied to the $30 billion gut health market, where its digestive benefits shine in teas and supplements. In the USA, 2025 imports could hit 50,000 tons, up 12% YoY, as plant-based burgers lean on cumin for authentic flavor.

At Sadbhaav, we source Unjha’s premium jeera during March-May harvests, powering our U.S. private-label blends. Our blockchain ensures 99% purity, meeting FDA standards, while 18% demand spikes for cumin-fennel teas reflect wellness trends. Despite drought-driven price hikes (15% in 2024), our farmer cooperatives stabilize supply. Cumin’s earthy warmth bridges Indian heritage to global tables, making it a top pick for importers seeking versatility.

3. Turmeric: The Golden Healer Captivating Wellness Warriors Worldwide

Turmeric, India’s golden gem, exported 180,000 metric tons in FY23, valued at $600 million, with 2025 projections reaching 210,000 tons, up 16%. Sourced from Erode and Sangli, its vibrant rhizomes pack 5-6% curcumin, the anti-inflammatory compound driving its global fame.

The USA leads with 30% of imports ($180 million), using turmeric in golden lattes and supplements, followed by the UAE (20%) for curries and Europe (15%) for organic cosmetics. A 15% CAGR from 2020-2025 reflects turmeric’s starring role in the $50 billion functional foods market, where 40% of U.S. millennials seek curcumin-rich products for immunity. Post-COVID, U.S. turmeric sales surged 25%, with health stores stocking powders and extracts.

Sadbhaav’s organic turmeric, solar-dried to retain potency, captures 10% of U.S. wellness exports. Our curcumin-rich blends, backed by Certificates of Analysis, meet stringent FDA norms. Monsoon delays in 2024 were countered by multi-region sourcing, ensuring steady supply. For importers, turmeric’s health halo and vibrant hue make it a must-have, with prices at ₹80-100/kg post-harvest. Turmeric isn’t just a spice—it’s a global health phenomenon.

4. Black Pepper: The King of Spices Ruling Premium Palates

Black pepper, dubbed the “King of Spices,” exported 150,000 metric tons in 2023, valued at $700 million, with 2025 projections at 165,000 tons, a 10% rise. Kerala’s Malabar Coast, producing 96% of India’s supply, yields peppercorns with 4-5% piperine, delivering a sharp, pungent kick.

Vietnam, a re-export hub, takes 25% of India’s pepper, while the USA (20%) uses it in steak seasonings and gourmet blends. The EU, at 18%, favors organic pepper for fine dining. With a 9% CAGR through 2025, pepper’s demand ties to the $100 billion weight-loss market, where piperine aids metabolism. U.S. organic pepper imports grew 12% in 2025, driven by clean-label rubs.

Sadbhaav sources Tellicherry pepper from Kochi, powering our premium U.S. lines. We’ve navigated 2024 EtO bans with irradiation, ensuring 99% clearance rates. Our QR-coded traceability boosts buyer trust. Priced at ₹500-600/kg post-harvest, pepper’s premium allure makes it a top choice for importers seeking bold flavors.

5. Coriander Seeds: The Versatile Staple in Fusion Feasts

Coriander seeds, with their citrusy warmth, exported 140,000 metric tons in 2023, valued at $400 million, with 2025 estimates at 155,000 tons, up 11%. Rajasthan’s fields produce seeds rich in 1-2% volatile oils, perfect for global blends.

Malaysia leads with 20% for curry pastes, followed by the USA (18%) for salsas and Latin dishes, and the UAE (15%) for biryanis. A 7.5% CAGR reflects coriander’s role in vegan trends, with its antioxidants boosting appeal in plant-based diets. U.S. demand for ground coriander in fusion cuisines grew 10% in 2025.

Sadbhaav sources from Khari Baoli, blending coriander for U.S. clients, with a 15% uptick in organic demand. Our HACCP-certified mills ensure purity, while early harvest buys (March-May) keep prices at ₹80-100/kg. Coriander’s versatility makes it a go-to for importers eyeing diverse markets.

6. Ginger: The Zesty Zing in Global Wellness Waves

Ginger, with its fiery zing, exported an estimated 80,000 metric tons in 2025 (up from 48,000 in 2017-18), valued at $300 million, reflecting a 50% value CAGR spurt. Northeast India’s fresh roots, packed with gingerol, fuel teas and supplements.

The USA takes 25% for wellness drinks, Saudi Arabia 20% for culinary uses, and the UK 15% for ginger shots. Demand for ginger’s nausea-relieving properties drives growth in the $50 billion functional beverage market, with 20% YoY U.S. import rises.

Sadbhaav’s dried ginger, sourced from Assam, meets U.S. demand for anti-nausea products. Our solar-dried process retains 25% more gingerol, with prices at ₹150-200/kg. Ginger’s zesty versatility ensures steady global demand, especially in health-conscious markets.

7. Cardamom: The Queen of Pods in Luxury Lanes

Cardamom, the “Queen of Spices,” exported 20,000 metric tons in 2023, valued at $500 million, with 2025 projections at 25,000 tons. Kerala’s green pods, with 3-4% essential oils, add aromatic depth to sweets and coffees.

Saudi Arabia consumes 30% for desserts, followed by the UAE (25%) for chai blends. A 10% CAGR reflects cardamom’s luxury appeal in the $20 billion confectionery market. U.S. imports grew 8% for artisanal baking.

Sadbhaav’s premium cardamom, sourced from Idukki, scents Middle Eastern markets. Our organic pods fetch ₹1,200-1,500/kg, with traceability ensuring EU compliance. Cardamom’s exclusivity makes it a high-value pick for premium importers.

8. Garlic: The Bulbous Boost for Bold Bites

Garlic exported an estimated 100,000 metric tons in 2023, valued at $250 million, with 2025 projections at 110,000 tons. Madhya Pradesh’s allicin-rich cloves power snacks and sauces.

The USA takes 20% for processed foods, Bangladesh 18% for curries. An 8% CAGR ties to garlic’s antimicrobial benefits in the $30 billion snack market. U.S. demand for dehydrated garlic rose 10% in 2025.

Sadbhaav’s dehydrated garlic, sourced from Indore, meets U.S. snack needs. Priced at ₹100-120/kg, our lab-tested cloves ensure purity. Garlic’s bold flavor secures its global spot.

9. Fennel Seeds: The Sweet Digestive Delight

Fennel exported 80,000 metric tons in 2023, valued at $150 million, with 2025 estimates at 88,000 tons. Gujarat’s anethole-rich seeds aid digestion, popular in teas.

The USA (25%) and UAE (20%) lead, with a 7% CAGR driven by the $10 billion digestive health market. U.S. fennel tea demand grew 15%.

Sadbhaav’s organic fennel, sourced from Unjha, powers U.S. wellness blends. Priced at ₹100-120/kg, our solar-dried seeds retain sweetness. Fennel’s soothing appeal captivates health-focused importers.

10. Sesame Seeds: The Nutty Newcomer in Health Foods

Sesame seeds were exported an estimated 300,000 metric tons in 2023, valued at $400 million, with 2025 projections at 330,000 tons. Gujarat’s unhulled seeds shine in health foods.

China takes 30% for re-export, the USA 15% for tahini and bars. A 9% CAGR reflects sesame’s role in the $40 billion plant-based market, with U.S. imports up 12%.

Sadbhaav’s organic sesame fuels U.S. trends, priced at ₹120-150/kg. Our diversified sourcing counters drought risks, ensuring supply. Sesame’s nutty crunch makes it a rising star.

Emerging Trends in the Indian Spice Export Market

2025 is a turning point for Indian spices. Blends like garam masala see 20% growth in the USA, while organic spices (30% of output) grow at a 7.11% CAGR to 2032. Digital platforms like e-NAM cut costs 20%, and the SPICED program boosts exports 15% via sustainability. EtO challenges? Steam sterilization resolves 70% of cases, restoring trust. Sadbhaav’s AI sorting ensures 98% purity, aligning with global clean-label demands. E-commerce, via Amazon’s Global Selling, drives 200% growth for small exporters, while blockchain traceability meets EU norms.

Conclusion: India’s Spices—Fueling a Flavorful Future

India’s top spices exported—from chilli’s fire to turmeric’s gold—power a $4.72 billion industry, with a 10.56% CAGR toward $10 billion by 2033. As global demand for wellness and fusion flavors soars, these spices connect India’s fields to world tables. At Sadbhaav Spices, we’re proud to lead with premium organics—contact us at sadbhaavspices.com to source the best. For importers and analysts, India’s spices aren’t just ingredients; they’re opportunities to savor and succeed.