Cumin, or jeera as it’s fondly called in Indian households, is far more than a humble spice that adds that signature nutty warmth to your favorite dal or tandoori chicken. It’s a cornerstone of global cuisines, a powerhouse of health benefits—from aiding digestion and boosting immunity to serving as a natural anti-inflammatory—and a vital cog in India’s agricultural economy. As the world’s largest producer and exporter of cumin, India commands nearly 70% of the global trade, shipping out bold, aromatic seeds that flavor everything from Mexican tacos to Middle Eastern tagines and American craft beers. In the fiscal year 2024-25, Indian cumin exports surged an impressive 39.63% year-over-year, reaching 212,502 metric tonnes (MT), underscoring the spice’s enduring appeal despite global economic headwinds like inflation and supply chain disruptions.

Yet, 2025 has been a rollercoaster for the cumin market. Early-year gluts from bumper harvests in Gujarat—India’s cumin epicenter—pushed prices down temporarily, but rising demand for organic and traceable varieties, coupled with geopolitical tensions affecting shipping routes, has stabilized the landscape. At Sadbhaav Exports, where we’ve been a premier bulk jeera supplier for over a decade, we’ve witnessed this volatility firsthand while delivering consistent quality to buyers across 50+ countries. Our direct farm-to-port model, sourcing from the sun-baked fields of Unjha and Jodhpur, ensures we not only meet but exceed international standards, helping clients navigate the complexities of “cumin export price India” queries and beyond.

This exhaustive guide is your one-stop resource for mastering cumin exports from India in 2025. We’ll delve deep into market dynamics, unpack pricing intricacies with real-time data, explore quality benchmarks that separate premium from pedestrian, and map out logistics strategies to minimize delays and costs. Whether you’re a seasoned importer fine-tuning your supply chain, a startup entrepreneur eyeing “bulk jeera supplier” partnerships, or a curious stakeholder tracking high-value sourcing terms, this blueprint will empower you to thrive in a market projected to hit $1.5 billion by year-end. Let’s embark on this flavorful journey, one seed at a time.

The Indian Cumin Landscape: Why We’re the Global Gold Standard

India’s dominance in cumin isn’t accidental—it’s rooted in geography, tradition, and innovation. Thriving in the semi-arid soils of Rajasthan (25% of production) and Gujarat (70%), cumin plants yield small, crescent-shaped seeds packed with essential oils that deliver that irresistible earthy, citrusy punch. The 2024-25 season saw production rebound to over 7.5 lakh MT, up from drought-hit lows, thanks to favorable monsoons and farmer adoption of drip irrigation and hybrid varieties promoted by the Spices Board of India (SBI).

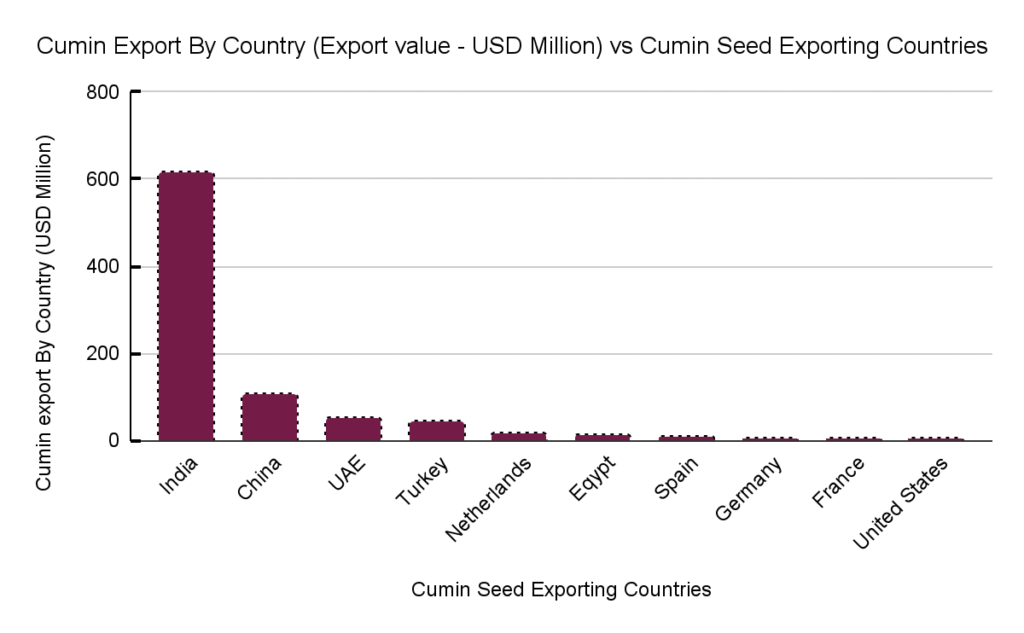

From a trade perspective, cumin isn’t just a commodity; it’s a cultural export. In FY 2024-25, exports clocked in at 212,502 MT—a 39.63% leap from the prior year—valued at approximately $1.2 billion USD. This growth bucks broader spice export trends, which dipped 5% overall due to tepid demand in key markets. India leads with over 70,514 recorded shipments, dwarfing competitors like Turkey (2,939 shipments) and China (1,509). The Unjha Agricultural Produce Market Committee (APMC), the bustling nerve center in Gujarat, reported a 17.5% surge in arrivals early 2025, totaling 54,410 MT between February and April alone, signaling robust supply readiness.

Diving Deeper: Key Market Drivers in 2025

- Health and Wellness Boom: Post-pandemic, cumin’s curcumin-like compounds have spotlighted it in functional foods. Organic cumin exports jumped 15-20%, with the USA importing 25% more for supplement blends.

- Culinary Globalization: From K-pop stars touting jeera chai to European fusion chefs experimenting with cumin-infused desserts, diverse applications are fueling a 10% demand uptick.

- Sustainability Shift: Buyers increasingly seek carbon-footprint-low cumin, prompting Indian exporters to adopt regenerative farming—practices that enhance soil health and yield 10-15% more resilient crops.

- Challenges on the Horizon: Climate variability, like the 2024 heatwaves that scorched 5% of Gujarat’s acreage, and stricter residue norms in the EU could pressure volumes. However, SBI’s tech interventions, including AI-driven weather forecasting for farmers, are mitigating risks.

At Sadbhaav Exports, we leverage this ecosystem by partnering with 500+ contract farmers, ensuring year-round availability and ethical sourcing. Our commitment to transparency—via blockchain-tracked batches—positions us as the ultimate authority for importers seeking reliable “bulk jeera supplier” solutions.

2025 Export Snapshot: At-a-Glance Stats

| Metric | Value (FY 2024-25) | YoY Change | Key Insights |

|---|---|---|---|

| Production Volume | 7.5 lakh MT | +8% | Gujarat leads; hybrids boost yields by 12%. |

| Export Volume | 212,502 MT | +39.63% | Strong shipments to USA/UAE; China dip offset by Vietnam gains. |

| Export Value | $1.2 billion USD | +12% | Organics contribute 25% premium; projections to $1.5B by Dec. |

| Top Destinations | USA (15%), UAE (12%), Bangladesh (10%), China (8%) | Stable | Re-exports via UAE add 20% value. |

| Variety Breakdown | Whole seeds (80%), Powder (15%), Oil/Extracts (5%) | +5% processed | Powder demand rises with ready-to-eat foods. |

These figures, drawn from SBI and APEDA data, highlight cumin’s resilience—making it a smart bet for diversified portfolios.

Mastering Cumin Pricing: Trends, Factors, and 2025 Forecasts

Pricing cumin exports is an art informed by science: a delicate dance between supply gluts, currency fluxes, and buyer whims. Indian jeera enjoys a 20-30% edge over Turkish or Iranian alternatives, thanks to its superior volatile oil content (2.5-4% vs. 1.5-2.5%), which translates to bolder flavor profiles. However, 2025’s narrative is one of cautious optimism—early-season abundance kept FOB prices in check, but escalating freight costs and a weakening rupee (hovering at ₹84/USD) have nudged them upward by 8-10% since Q2.

Core Pricing Influences Unpacked

- Seasonal Swings: The February-April harvest floods markets, slashing prices by 15-25% (e.g., from $3,200/MT to $2,600/MT). Off-season (Oct-Jan), scarcity reverses this, with premiums for stored stocks.

- Grade and Origin Nuances: “Singapore-origin” cumin—clean, uniform seeds sorted for Asian markets—commands $200-300/MT more than “Europe-origin” (finer but dustier). Organic certification? Add another 25-40% uplift.

- Geopolitical and Economic Ripples: US tariffs (up to 25% on non-FTA goods) inflate landed costs by 15%, while Red Sea reroutings via Cape of Good Hope tack on $150-200/MT in freight. Conversely, the India-UAE CEPA slashes duties by 5-7% for Gulf-bound shipments.

- Demand-Supply Equilibrium: China’s pivot to local production created a 10% volume vacuum early 2025, but surging US health-food imports (up 18%) balanced it. Domestic Indian consumption, at 40% of production, also absorbs surpluses.

Current Cumin Export Prices: October 2025 FOB India Breakdown

| Grade/Type | Price Range (USD/MT) | Primary Markets | 2025 Trend Analysis |

|---|---|---|---|

| Premium Whole (Singapore Origin, Grade A) | 2,950-3,150 | USA, Singapore, EU | Up 7% QoQ; high oil content (3.5%+) drives demand. Weekly fluctuations ±5%. |

| Standard Whole (Europe Origin, Grade B) | 2,750-2,950 | China, Bangladesh | Stable but volatile; down 3% post-harvest glut. Ideal for blends. |

| Cumin Powder (Ground, Sterilized) | 3,300-3,600 | Middle East, Europe | Rising 10%; convenience factor boosts 20% in processed exports. |

| Organic Whole Seeds (Certified) | 3,800-4,200 | USA, Germany | Premium surge 15%; NPOP/USDA tags add traceability value. |

| Cumin Oil (Steam-Distilled) | 45-55 USD/kg | Cosmetics, Pharma | Niche growth 12%; purity >99% fetches top dollar. |

These rates, benchmarked against NCDEX futures and international indices, reflect mid-October stability after April’s low of $2,795/MT for Grade A. Forward contracts—locking prices 3-6 months ahead—remain a savvy hedge; at Sadbhaav, our bulk jeera supplier volumes (20+ MT orders) secure 5-10% discounts, averaging $2,950/MT last quarter.

Forecasting Ahead: What to Watch in Late 2025 Analysts predict a 5-8% price hike by December, driven by festive-season draws in India and holiday blends abroad. For buyers, timing purchases post-Diwali (November) could yield savings, while exporters should eye SBI’s export incentives (up to 4% RoDTEP refunds) to buffer margins. Sadbhaav’s pricing intelligence dashboard, powered by real-time market feeds, helps clients forecast and lock in value—ensuring you’re never caught off-guard.

Quality Assurance: Elevating Cumin to Export Excellence

In the cumin trade, quality isn’t a checkbox—it’s the bedrock of repeat business and regulatory compliance. Indian seeds naturally excel with their rich cumin aldehyde content (up to 40% of essential oils), but inconsistent farming practices can introduce contaminants like aflatoxins or heavy metals. The 2024 ethylene oxide (EtO) recalls in Europe, affecting 10% of spice imports, were a wake-up call: only exporters with ironclad quality protocols survived unscathed.

Essential Quality Metrics: A Deep Dive

| Parameter | Export Standard Threshold | Testing Protocol | Impact on Trade |

|---|---|---|---|

| Purity & Foreign Matter | 99% min (no stones/dust) | Gravimetric sieving | Core buyer spec; rejects spike 20% without it. Ensures uniform processing. |

| Moisture Level | ≤9% | Karl Fischer titration | Mold prevention; vital for 30-45 day sea voyages. High moisture = 15% value loss. |

| Essential Oil Content | 2.5-4.0% min | Hydro-distillation | Flavor benchmark; Indian avg. 3.2% outshines global 2.8%. |

| Pesticide Residues | <0.01 ppm (EU MRLs) | LC-MS/MS spectrometry | Compliance gateway; organics test to 0.001 ppm. Non-compliance = full shipment bans. |

| Microbial Contaminants | Salmonella: Absent; TPC <10^5 CFU/g | PCR/Plate culture | FDA/USDA must-have; irradiation optional for sterilization. |

| Aflatoxin Levels | <4 ppb (B1) | HPLC analysis | Health safeguard; climate-stressed crops risk higher—mitigate with storage tech. |

Beyond specs, holistic quality encompasses varietal purity (Cuminum cyminum L. only) and aroma profiling via GC-MS for authenticity. Certifications are non-negotiable:

- SBI Registration & Spice House Program: Vets processing units for GMP.

- Global Food Safety (GFSI) Benchmarks: HACCP/ISO 22000 for risk-based controls.

- Organic Accreditations: NPOP (India), USDA NOP, EU Organic—verified annually, boosting premiums.

- Traceability Tools: QR-coded batches linking to farm GPS data, as mandated by upcoming FSMA 204 in the USA.

At Sadbhaav Exports, our zero-defect ethos shines through NABL-accredited triple-testing (farm, warehouse, pre-shipment) and solar-powered drying facilities that preserve volatiles without chemicals. We’ve achieved 100% compliance in 2025 audits, earning us accolades as a top “high-quality cumin export India” provider. For importers, requesting a Certificate of Analysis (CoA) with every quote is table stakes—our samples ship free for verification.

Quality Case Study: From Field to Flavor Consider a recent 50 MT order to Germany: Sourced from Rajasthan’s organic belts, seeds hit 3.8% oil content post our steam-sterilization. Result? Zero residues, 99.5% purity, and a delighted client who reordered triple the volume—proof that investing in quality yields 25% higher retention rates.

Logistics Unraveled: Seamless Pathways from Indian Farms to Your Doorstep

Logistics in cumin exports is the unsung hero—bridging Gujarat’s mandis to Rotterdam’s docks without compromising freshness. India’s spice infra, with ports like Mundra (handling 40% of exports) and Kandla, supports 15-25 day ETAs, but 2025’s challenges—Suez Canal fees up 20%, container shortages—demand strategic finesse.

Comprehensive Logistics Framework: Step-by-Step

- Procurement & Initial Handling: Daily auctions at Unjha APMC; we aggregate via cold-chain trucks to warehouses. Sorting via optical graders removes 2-3% impurities on-site.

- Packaging Protocols: 25/50kg double-laminated PP/jute bags with moisture-barrier liners; fumigation (methyl bromide or phosphine) per IPPC standards. For powders, nitrogen-flushed pouches extend shelf life to 18 months.

- Documentation Arsenal: Beyond basics (Invoice, B/L, Packing List), include Phytosanitary Certificate (from PPQS), Radiation Cert (if treated), and FSSAI License. Digital filing via ICEGATE streamlines customs in 24-48 hours.

- Freight Modalities:

- Ocean Freight (Primary, 85% Volume): Full Container Load (FCL) 20ft holds 16-18 MT; rates $1,800-2,200 to West Coast USA (up 12% YoY). LCL for samples: $50-80/cbm.

- Air Freight (Urgent/Small Lots): $4-6/kg to Europe; ideal for high-value organics.

- Multimodal Hacks: Rail to port (saves 10% vs. road), then feeder vessels to hubs like Jebel Ali for re-export.

- Clearance & Last-Mile: Destination duties (e.g., 2.5% EU tariff) handled via Incoterms like FOB/CIF; we offer DDP for door-to-door peace.

- Risk Mitigation: All-risk insurance at 110% invoice value; GPS trackers for real-time visibility. Sustainability? Bio-degradable packaging cuts plastic by 30%.

2025 Logistics Pain Points & Solutions

- Cost Escalation: Freight up 15%—counter with consolidated shipments or India-ASEAN FTAs for duty waivers.

- Delays: Weather/port congestion adds 5-7 days—buffer with 10% inventory stockpiles.

- Eco-Logistics: Carbon-neutral carriers like Maersk’s green vessels appeal to EU buyers, justifying 3-5% premiums.

Sadbhaav’s in-house logistics arm, with dedicated Mundra warehousing, slashes turnaround to 5-7 days. We’ve rerouted 30% of 2025 shipments via safer Indian Ocean paths, saving clients $100/MT on average.

Top Cumin Exporters Spotlight: Power Players in 2025

| Exporter Name | Base Location | Est. Annual Volume (MT) | Standout Features |

|---|---|---|---|

| Sadbhaav Exports | Ahmedabad, Gujarat | 20,000+ | Blockchain traceability; 100% organic options; 98% on-time delivery. |

| MTE Spices Inc. | Rajkot, Gujarat | 15,000 | EU-focused; specialized in powder sterilization. |

| Ashapura Global Traders | Jodhpur, Rajasthan | 12,000 | High-volume whole seeds; strong Middle East ties. |

| Vora Brothers Exports | Unjha, Gujarat | 10,000 | Custom blends; rapid sampling turnaround. |

| Dhaval Agri International | Ahmedabad, Gujarat | 8,500 | Sustainable farming certifications; air-freight expertise. |

These leaders control 55% of flows, with Sadbhaav topping for innovation.

Insider Strategies: Thriving as a Cumin Buyer or Exporter in 2025

For Importers:

- Diversify sources: Blend Gujarat boldness with Rajasthan subtlety for balanced profiles.

- Negotiate milestones: 30% advance, balance on B/L—ties payments to quality.

- Trend-Surf: Stock organics now; cumin’s gut-health halo could spike 25% demand.

For Exporters:

- Go Digital: SBI’s SpiceNet for leads; AI analytics for yield prediction.

- Value-Add: Oleoresin extraction yields 5x margins over raw seeds.

- Risk Hedge: Currency forwards against rupee volatility.

Common Trap: Overlooking residue testing—costs $50/MT but saves fortunes in recalls.

Partner with Sadbhaav Exports: Your Cumin Success Catalyst

In the intricate world of cumin exports, knowledge is power, but partnership is profit. At Sadbhaav Exports, we’re more than a bulk jeera supplier—we’re your co-pilot for sourcing excellence, from competitive “cumin export price India” negotiations to flawless logistics orchestration. With a 95% client retention rate and zero quality disputes in 2025, we’ve earned our stripes as the ultimate authority.

Ready to elevate your cumin game? Reach out to our team for a personalized consultation, free sample kits, or tailored quotes. Let’s turn market insights into your competitive edge—your next big order awaits.

Disclaimer: All data and prices are indicative as of October 29, 2025, and subject to market fluctuations. Consult certified professionals for binding advice. Individual results may vary based on specific circumstances.

Last Updated: October 29, 2025 If this guide spiced up your strategy, share it with a fellow trader—let’s keep the conversation cumin-fresh!